Washington State Electric Vehicle Sales Tax Exemption Form. In washington state, if you are paying an electrician to install an evse like the tesla wall charger, you should not pay. Beginning july 1, 2022, 50% of the retail sales and state use tax does not apply to the sale or lease of the first 650 purchases of.

In the case of washington state, rcw 82.08.816 offers such a sales tax exemption through july 1, 2025. In washington state, if you are paying an electrician to install an evse like the tesla wall charger, you should not pay.

Beginning July 1, 2022, 50% Of The Retail Sales And State Use Tax Does Not Apply To The Sale Or Lease Of The First 650 Purchases Of.

(reference revised code of washington 43.330.365) electric vehicle (ev) charger destruction prevention.

Ev Battery Sales And Use Tax Exemption.

An exemption for ev battery purchases, installation, and repair services.

By Scott Mcclallen | The Center Square.

Images References :

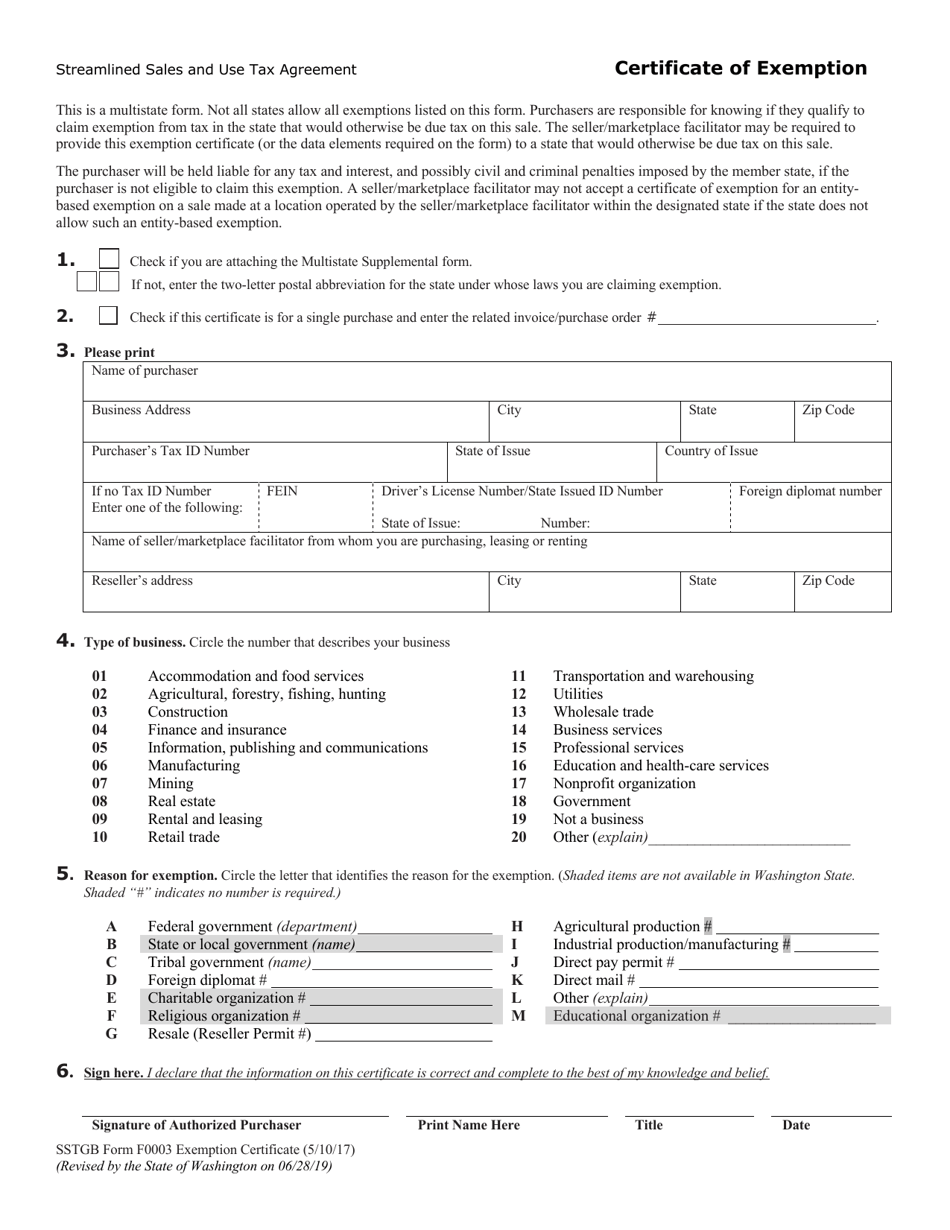

Source: www.templateroller.com

Source: www.templateroller.com

SSTGB Form F0003 Fill Out, Sign Online and Download Fillable PDF, Fuel cell electric vehicle (fcev) tax exemption. The state requires that the system be capable of.

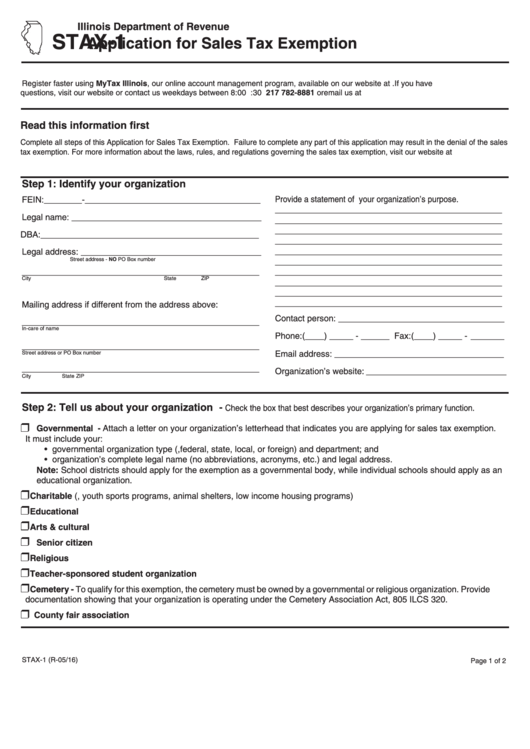

Source: www.exemptform.com

Source: www.exemptform.com

Stax1 Application For Sales Tax Exemption Illinois Printable Pdf, Ev battery sales and use tax exemption. In the case of washington state, rcw 82.08.816 offers such a sales tax exemption through july 1, 2025.

Source: istiklalsporluyuz.blogspot.com

Source: istiklalsporluyuz.blogspot.com

kansas sales and use tax exemption form Virulent Ejournal Photo Galery, In the case of washington state, rcw 82.08.816 offers such a sales tax exemption through july 1, 2025. According to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington state.

Source: www.signnow.com

Source: www.signnow.com

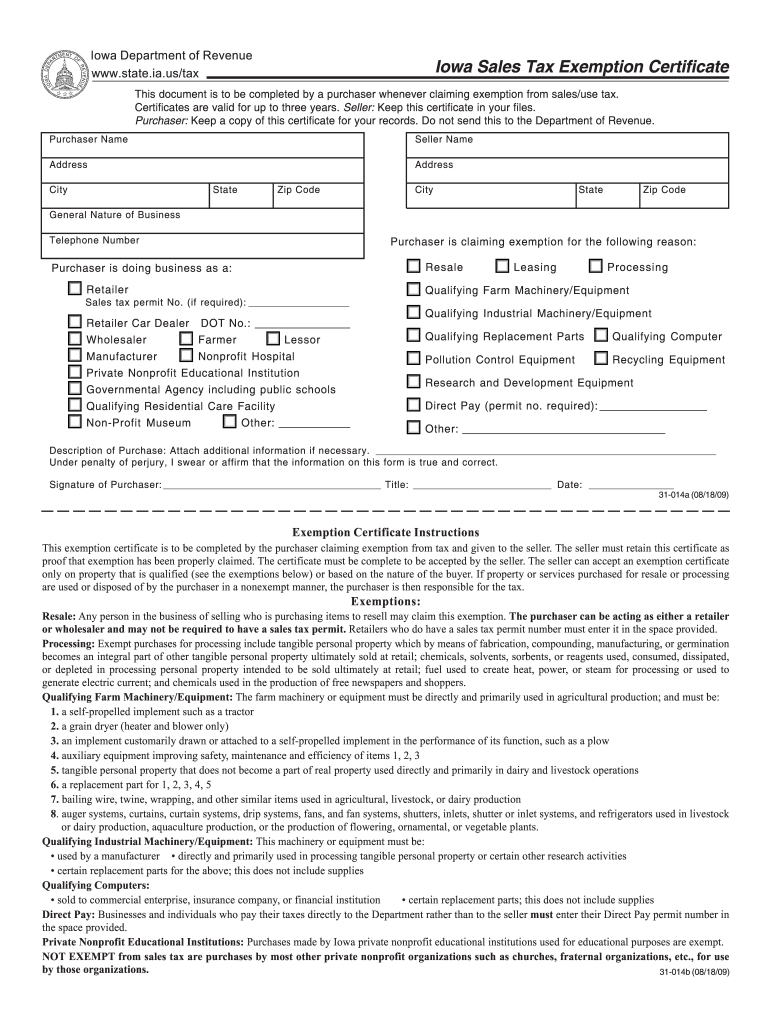

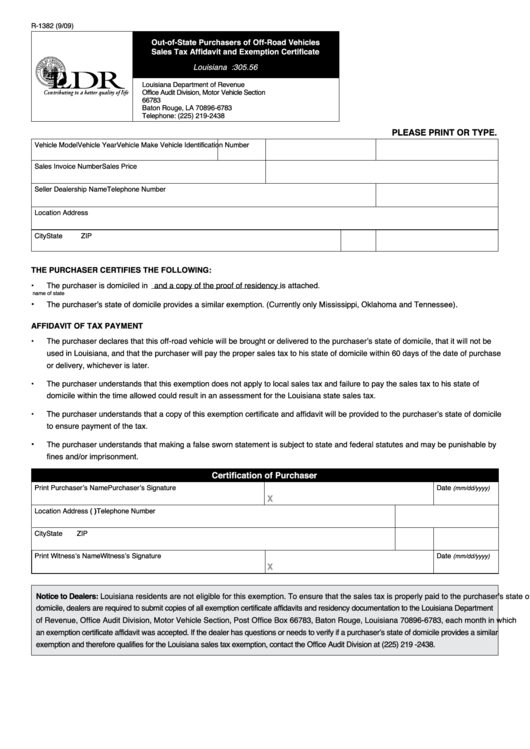

Iowa Sales Tax Exemption Certificate Fillable Form Fill Out and Sign, On top of that is a 0.3 percent lease/vehicle sales tax. Starting august 2023, the exempt.

Source: endehoy.com

Source: endehoy.com

Texas Sales Tax Exemption Form Video Bokep Ngentot, An exemption for ev battery purchases, installation, and repair services. Taxpayers in washington may be eligible to receive a sales tax exemption for qualifying solar energy systems.

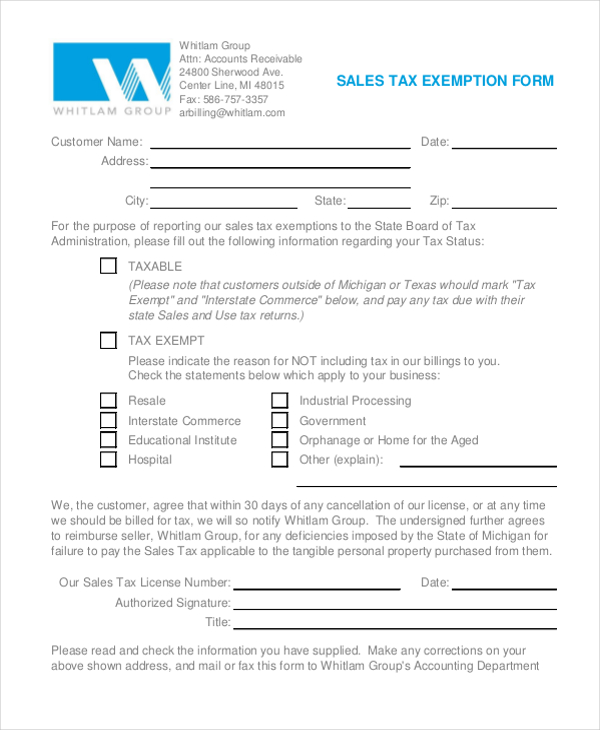

Source: www.dochub.com

Source: www.dochub.com

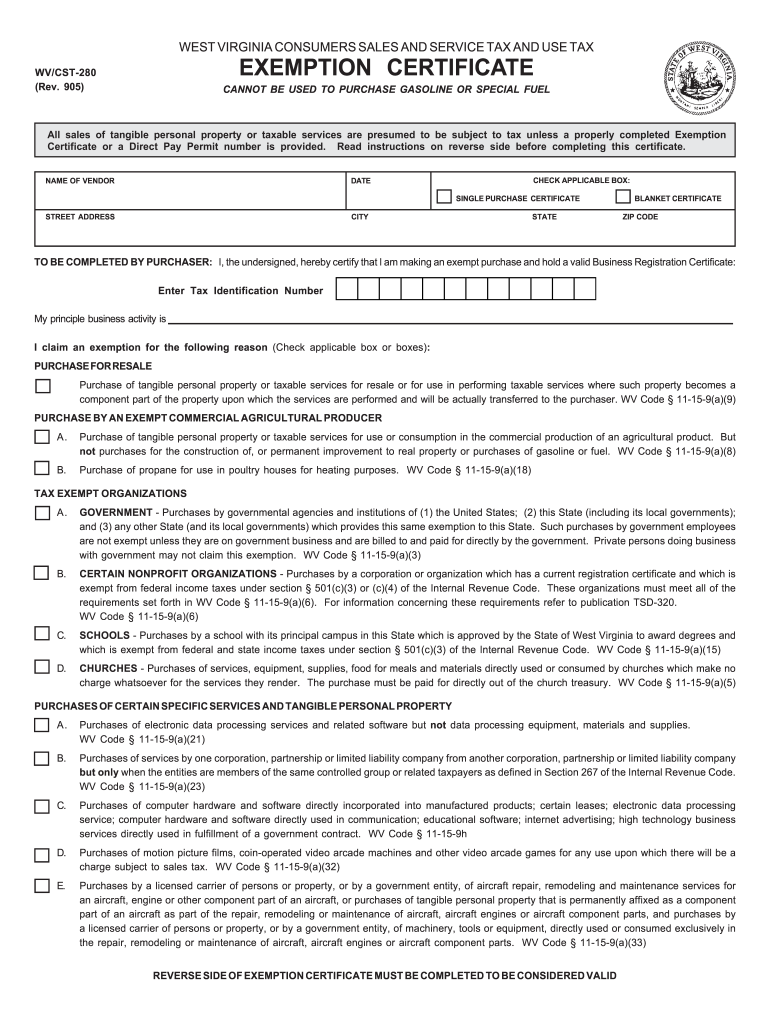

Wv tax exempt form Fill out & sign online DocHub, For more information on tax exemptions, see our 2016 tax exemption study. In washington state, if you are paying an electrician to install an evse like the tesla wall charger, you should not pay.

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, Washington state has given 25,276 sales and use tax exemptions to electric vehicles. That, in some cases, can be combined with a state sales tax waiver on up to $15,000 of the purchase price of new cars valued at $45,000 or less, or used cars that.

Source: printableformsfree.com

Source: printableformsfree.com

2023 Tax Exemption Form Printable Forms Free Online, The state of washington offers several incentives and rebates for electric vehicles and charging infrastructure, mostly in the form of tax exemptions. Starting august 2023, the exempt.

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form R1382 OutOfState Purchasers Of OffRoad Vehicles, Qualified for the sales/use tax exemption; In the case of washington state, rcw 82.08.816 offers such a sales tax exemption through july 1, 2025.

Source: www.exemptform.com

Source: www.exemptform.com

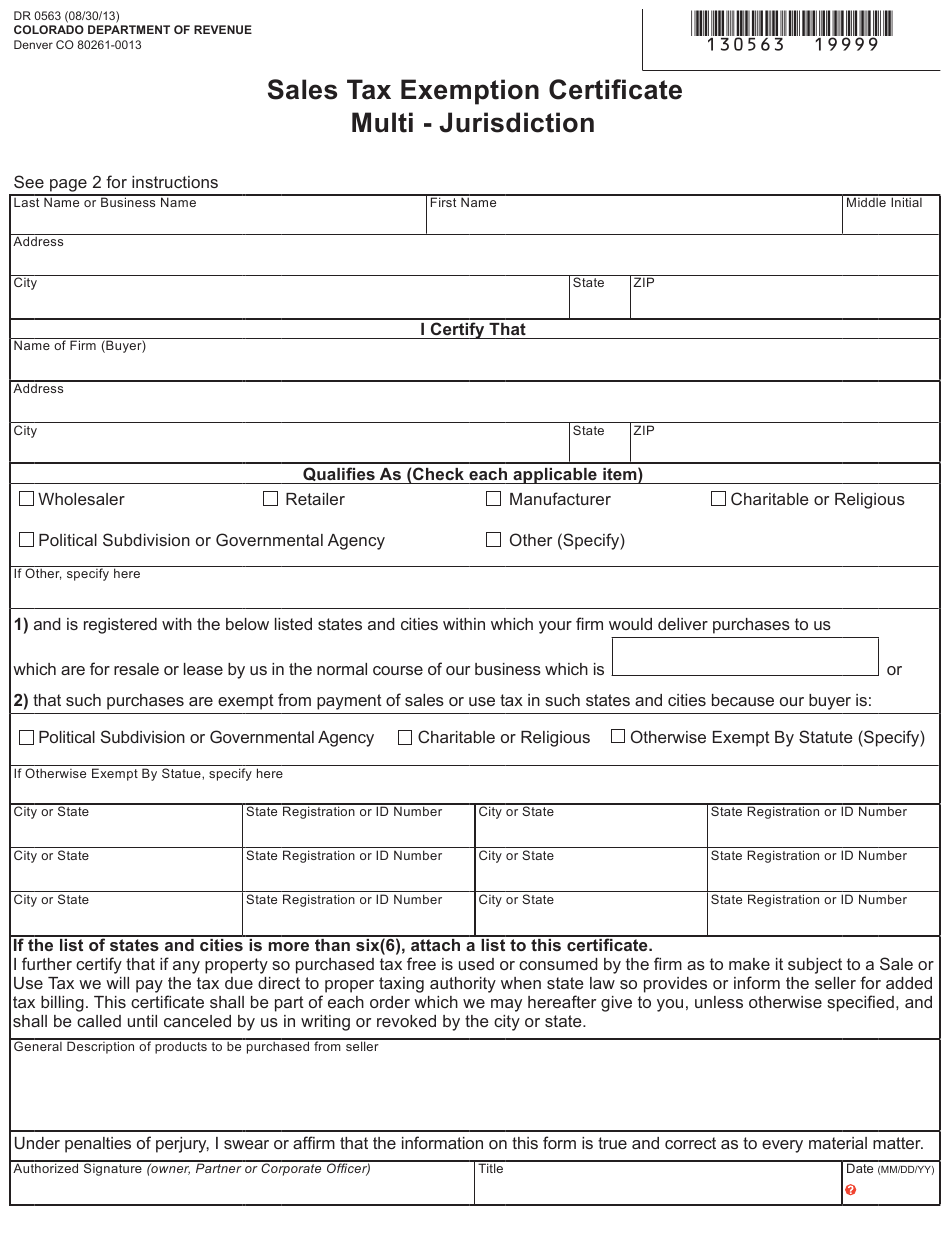

Colorado Sales Tax Exemption Certificate Form, For more information on tax exemptions, see our 2016 tax exemption study. 1, 2020, you may request a refund of the state portion of retail sales tax (6.5%) that you paid on eligible purchases in the prior year.

For The Full Details, Refer To The Ev Infrastructure Sales/Use Tax Exemption And Leasehold Tax Exemption On The Department Of Revenue Washington State’s Website.

The information below lists sales and use tax exemptions and exclusions.

Beginning July 1, 2022, 50% Of The Retail Sales And State Use Tax Does Not Apply To The Sale Or Lease Of The First 650 Purchases Of.

The state requires that the system be capable of.